CFD trading, or trading Contracts for Big difference, has become increasingly common among informed investors looking to influence industry opportunities. But what exactly does cfd trading entail? This manual may breakdown its important features, how it operates, and the potential dangers and advantages you should know about.

What is CFD Trading?

A Contract for Big difference (CFD) is a financial derivative that allows traders to speculate on cost actions without buying the main asset. Whether industry price is increasing or slipping, CFD traders may profit by leveraging these fluctuations.

CFDs cover a wide range of assets, including shares, commodities, indices, and cryptocurrencies. As an alternative of shopping for gives or a tangible advantage overall, you're basically entering into a contract with a broker to change the huge difference within an asset's price between enough time you open and close the trade.

How Does CFD Trading Work?

Here's a simple breakdown of how CFD trading works:

1. Select Your Asset: Choose the asset you wish to deal, such as for instance silver, computer shares, or Bitcoin.

2. Speculate on Action: Anticipate whether the cost can increase (go long) or fall (go short).

3. Control Your Place: Use influence to multiply your experience of the marketplace while only adding a portion of the full total trade value.

4. Monitor and Shut the Business: Monitor industry efficiency and close the industry when you're satisfied with the outcome (profit or loss).

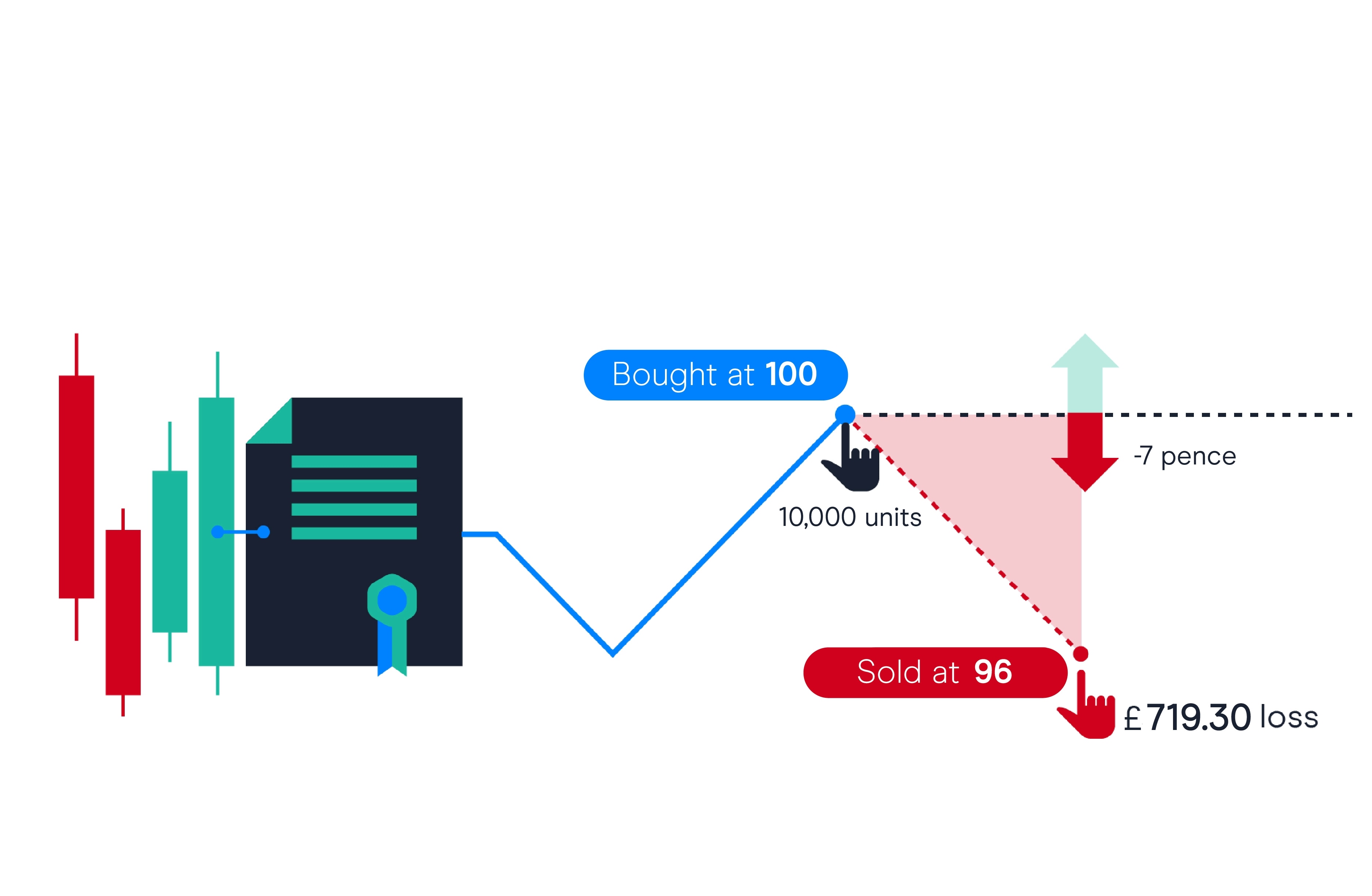

For example, if you imagine Tesla inventory will increase, you'll open an extended CFD position. If Tesla's stock comes up as predicted, you'll earn a profit corresponding to the purchase price movement. But, when it drops, you'll incur a loss.

Professionals and Disadvantages of CFD Trading

CFDs offer flexibility, but they are perhaps not without risks.

Benefits of CFD Trading:

• Control: A small investment regulates a bigger industry place, increasing possible returns.

• Range: CFDs cover sets from forex to key stock indexes, offering diversity.

• Profit Possible in Both Areas: You are able to deal in growing or slipping markets.

Risks to View Out For:

• Large Risk Due to Power: While influence raises increases, in addition it magnifies losses.

• Market Volatility: Rates can swing fast, which creates significant risks.

• No Advantage Possession: You never possess the asset you're trading, so there are number additional money channels like dividends.

Is CFD Trading Proper for You?

CFD trading offers fascinating possibilities for investors with a knack for predicting market swings. However, their high-risk, high-reward character helps it be more ideal for experienced traders or these willing to dedicate the time and energy to learning the ropes.